FG Plans 50% Tax Relief To Help Firms Increase Salaries

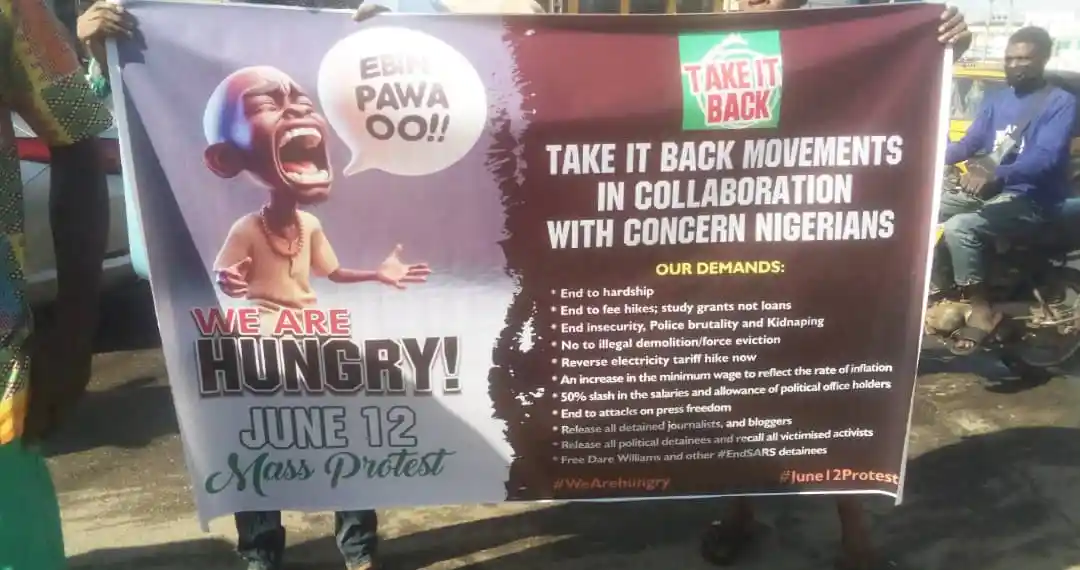

The Federal Government is set to provide a 50% tax relief to companies that raise salaries or provide transportation allowances to low-income employees, as part of a new bill aimed at overhauling Nigeria’s tax system.

According to The PUNCH,The proposed legislation, titled “A Bill for an Act to Repeal Certain Acts on Taxation and Consolidate the Legal Frameworks relating to Taxation and Enact the Nigeria Tax Act to Provide for Taxation of Income, Transactions, and Instruments, and Related Matters,” was submitted to the National Assembly on October 4, 2024.

The bill aims to introduce specific income tax exemptions to encourage companies to adjust wages. According to its provisions, businesses will be eligible for an additional 50% tax deduction in their assessment years for costs incurred during 2023 and 2024.

Eligible expenses include salary increases, transportation subsidies, or allowances provided to employees with gross monthly earnings up to N100,000. However, salary adjustments for employees earning over N100,000 per month will not qualify for this deduction.

Furthermore, companies that expand their workforce with a net increase in new hires between 2023 and 2024 will also be eligible for the deduction, provided the new hires remain employed for at least three years without involuntary termination.

In addition, the government is proposing a 25% income tax on individuals earning over N100 million annually.

The bill specifies, “A company shall be entitled to an additional deduction of 50 per cent in the relevant years of assessment for expenses incurred during 2023 and 2024 in the following areas:

Wage awards, salary increases, transportation allowance, or transport subsidy for low-income workers, provided it raises their monthly income to a maximum of N100,000. Salary increases for employees earning more than N100,000 will not be eligible for this deduction.

Salaries of newly hired employees leading to a net increase in workforce over 2023 and 2024 compared to the average workforce size of the prior three years, provided the employees remain for at least three years without involuntary dismissal.

The bill also introduces an Economic Development Incentive Certificate as a tax incentive for companies investing in capital projects. To apply, companies must submit their applications through the Nigerian Investment Promotion Commission (NIPC), along with a non-refundable fee of 0.1% of the capital expenditure, capped at N5 million.

The NIPC will review applications and recommend qualified companies to the Minister, who may then forward them to the President for final approval.

-

Previous Post

Sango Fire Outbreak: Senator Sympathies With Victi..

-

Next Post

AFCON qualifiers: CAF hands victory to Nigeria, fi..

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.webp)